Introducing Safenet

Safenet, the groundbreaking transaction processor network from the Safe Ecosystem Foundation, is designed to scale decentralized finance (DeFi) and move the $100 trillion global economy onchain by solving liquidity fragmentation and enabling instant, secure cross-chain transactions.

TL;DR

Safenet is not a blockchain or layer 2, it’s a transaction processor network that works on top of any existing or future chain and even connects onchain and offchain networks like Visa, CEXs, etc.

The core components of Safenet are Processors and a Liquidity Network

Safenet unbundles transaction execution and settlement, bringing execution guarantees to onchain transactions

Safenet is fast - very fast! Bringing Solana-like speed to Ethereum and its L2s, and making cross-chain interactions quick and seamless.

The largest smart account ecosystem

Since its founding in 2022 as a spin-off from Gnosis, Safe has grown into the leading smart account ecosystem, securing approximately $69 billion in total value (TVL) across more than 11 million accounts. Within the last 12 months, over $150B in transfer volume, also known as total volume processed (TVP), originated from Safe. This is comparable to 0.16% of the world’s GDP!

Projects like Polymarket, World App and 200+ other builders rely on Safe Smart Accounts to provide secure, self-custodial wallets with seamless, web2-like user experiences.

The Vision: Move the world’s GDP onchain

At Safe, we think the potential of blockchains extends beyond “memecoin casinos” or “airdrop farms”.

Blockchains have a real shot at becoming the global settlement layer for our society to coordinate, transact, and bring the world closer together. To achieve this vision, the goal is clear: move the entire world’s economy (i.e., GDP) onchain.

However, there are major challenges that need to be solved:

Fragmentation: Different Layer 1 and Layer 2 solutions create isolated ecosystems and blockchains are not sufficiently integrated with off-chain financial networks

Latency: Cross-chain transactions suffer from delays due to bridging and block times.

Complexity: Security concerns and user experience barriers prevent mainstream adoption.

Introducing Safenet: VisaNet but onchain

Today, Safe announces the extension of its offering with Safenet, a novel transaction processor network aimed at revolutionizing the decentralized finance landscape by streamlining blockchain transactions, taking inspiration from VisaNet.

A common misconception about VISA is that they issue cards or payment terminals. Instead, VISA primarily operates as a payment processing network (VisaNet) that connects different financial institutions (Card issuer, banks, clearing houses, etc.) in order to facilitate fast, secure payments all around the globe.

A second misconception is that, when paying with a VISA-enabled card at a point-of-sale, there is money changing hands immediately. What actually happens when a card is swiped, is that VisaNet checks the buyer’s balance and reserves the required assets, while simultaneously issuing a payment execution guarantee to the merchant bank. Money is only transferred as part of the settlement, usually 2-3 days after the purchase. So the magic of VISA comes from unbundling the execution guarantee and settlement of a transaction.

Safenet brings a similar architecture to onchain transactions in a decentralized way, connecting relevant stakeholders and issuing the required guarantees to orchestrate advanced transaction execution and achieve better transaction properties like

Speed: Safenet pushes the limits of current transaction speeds, with execution guarantees under 500ms, even for cross-chain transactions.

Security:Safenet enforces user-defined policies and security checks, protecting against prevalent risks like address poisoning.

Scalability: Users enjoy a unified asset balance accessible across diverse ecosystems, from Ethereum and Layer 2 networks to non-EVM-compatible chains like Solana. Safenet even enables using onchain assets through offchain channels like physical cards or centralized exchanges (CEXs).

How Safenet works

Safenet is powered by Safenet Processors, which act as execution nodes similar to Ethereum Layer 2 sequencers, taking over the key role for separating transaction execution from settlement.

Safenet Processors:

Issue resource-locks on user accounts to ensure asset availability.

Execute user transactions using external liquidity, achieving instant execution.

Provide execution guarantees, including security checks and user-defined policies.

Use validity proofs to settle transactions on the user account.

Underpinning this is the Safenet Liquidity Network. This liquidity network enables processors by providing the required liquidity to execute transaction intents, aggregating existing DeFi primitives like DEXs, Lending Markets and other liquidity sources.

For more details, check out the technical documentation.

Safenet Processor Economy

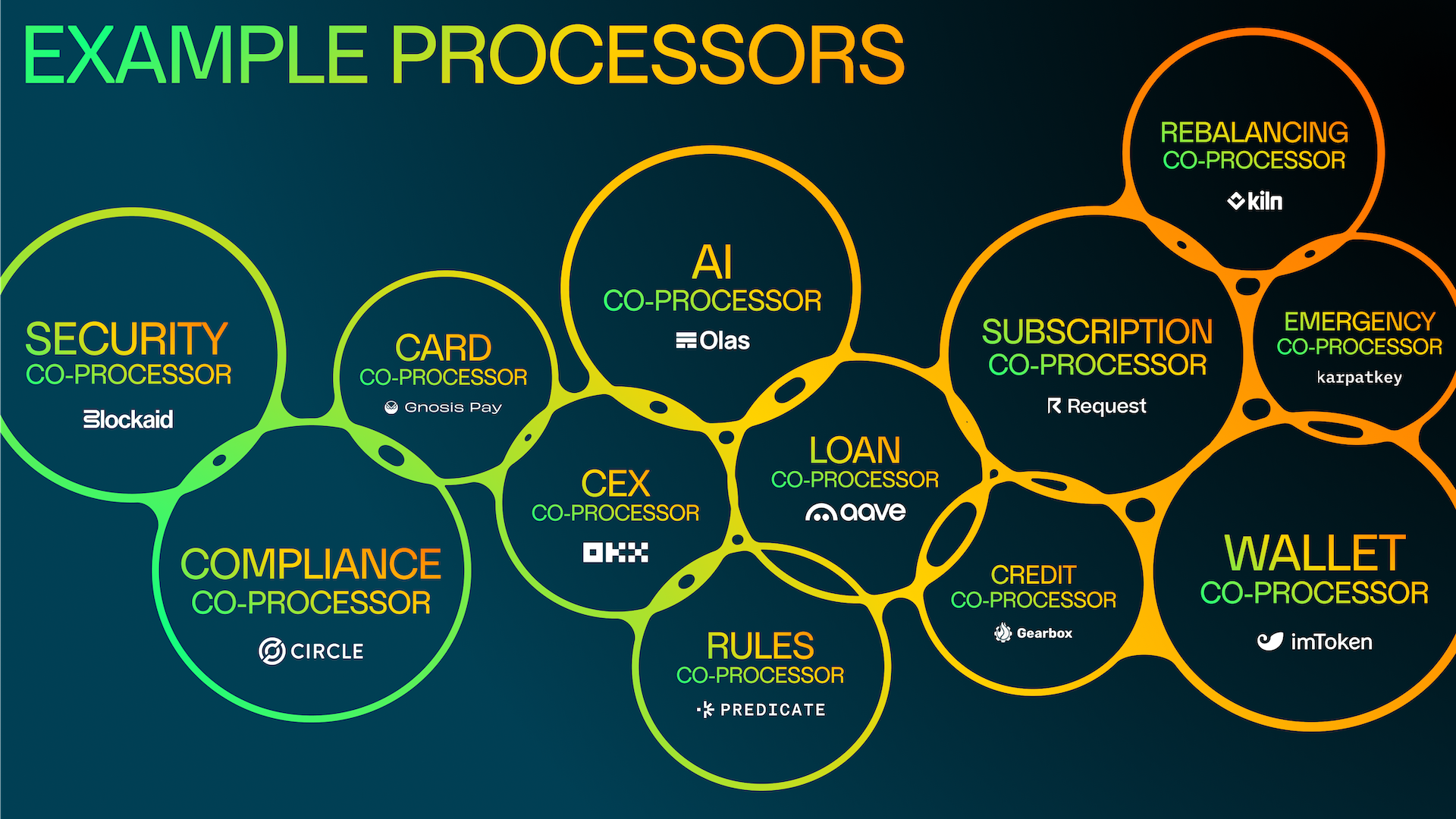

Safenet is much more than just a solution to network fragmentation. Safenet is designed to enable an economy of different application-specific processors. These can range from unique transaction guarantees, to connecting the user’s balance to new networks and even off-chain services (cards, CEXs). Processors will bring the peace of mind and functionality of custodial services, but with the control of self-custody.

The Safenet Processor Network is expected to be the basis of many innovations around onchain transactions. Such as:

Off-exchange settlement: A processor that allows users to trade on a centralized exchange using assets fully held in self-custody avoiding any counterparty risk. Transactions are executed offchain on the CEX and periodically settled onchain.

Loans: Users may be able to acquire an NFT with only a partial downpayment with the help of a lender, with a processor guaranteeing the NFT being locked on the account and transferred to the lender if the interest on the loan is not paid.

Subscriptions: A service to commit to monthly payments that get triggered periodically by the processor.

… and many more

Processors can take various types of fees (volume-based, recurring, flat-fee) for their services, directly tapping into the significant transfer volumes and adoption of Safe Smart Accounts. Safenet is enabling entirely new business models for providing additional user value as part of the transaction lifecycle, forming a new onchain economy.

Decentralized Validator Network

In order to strengthen the security of Safenet, SAFE validators monitor the activity of processors. If any transactions are triggered maliciously or not in compliance with user-set policies, validators can trigger challenges. More validators mean that faulty actions within Safenet can be flagged with a higher confidence.

The SAFE Token underpins the economic model of Safenet, aligning incentives across its ecosystem. It plays a critical role in ensuring security, scalability, and decentralization:

Processors: Processors have to be staked with SAFE in order to participate in Safenet’s economic opportunities. The required stake needs to be proportional to transfer volumes being processed and can also be provided by the community through pooled staking (e.g. via a restaking protocol like EigenLayer).

Validators: Validators must also stake to prevent DDoS attacks. SAFE Validators earn a portion of the Processor and/or Safenet fees as rewards for validating transactions.

Safenet is coming 2025

A first alpha version of Safenet is scheduled to be released in Q1 2025. which includes the basic ability to generate cross-chain accounts. Safenet will initially be limited to certain assets and transfer limit as the liquidity network is bootstrapped.

Future development and implementation of Safenet will be subject to SafeDAO's ratification, with the envisioned approach outlined as follows:

In Q2 2025, Safenet will be made compatible with apps that have integrated the Safe Apps SDK. Additionally, the SAFE validator network should be decentralized to further increase the security properties of Safenet.

In the second half of 2025 the focus will shift to scaling the liquidity network and introducing third-party processors that will unlock the real power of Safenet. Making Safenet compatible with ERC-7579 will further increase its reach and composability.

Get Involved!

Join the community on Telegram

To use Safenet, sign up to the Waitlist

Check Safenet technical docs

Disclaimer

Safenet is currently a research and software development project initiated by the Safe Ecosystem Foundation (SEF). The software is in an early development phase and remains subject to ongoing development and potential changes. No utility regarding the token is guaranteed at this stage. Please note that Safenet will not be directly operated by SEF; its live implementation, particularly the mainnet deployment, is contingent upon decisions made by SafeDAO and may involve third-party participation. All details are subject to governance and further review.

Get the Alpha

Sign up to hear the latest from Safe in your inbox

©2023–2025 Safe Ecosystem Foundation